Content

Whatever your Credit Card Billing Cycles is on that day is what will be reported to the bureaus, and that will determine your credit utilization, or the amount of credit you’re using relative to your credit limits. First, you can avoid paying interest on your balance if you pay in full. Second, it can improve your credit score by keeping your credit utilization low. And finally, if you miss a payment, your credit card company may report it to the credit bureaus, which would lower your credit score. Another aspect of a credit card billing is the payment due date cycle. What essentially happens is that a credit card is an unsecured or secured loan, and the credit card issuing company allows some days or weeks as an interest-free period for paying this loan. This is called the payment due date, i.e., the date by which the payment for a particular credit card statement is due.

- The monthly premium rate is US$0.52 per US$100 of the outstanding balance.

- If you’re trying to pay off your balance quickly, you may want to choose a due date that’s earlier in the month.

- Unlimited physical and virtual cards, available instantly, accepted everywhere.

- Your credit scores are one of the most important financial information you have.

- For example, if the first day of your billing cycle is January 23 and the last day is February 20, your billing cycle would be 29 days long.

- Did you know that using a credit card is safer than using debit cards or cash?

If you https://intuit-payroll.org/ on spending the money right away, you should consider the estimated time it will take for the transaction to complete. You can use your credit card on your due date as long as the account is in good standing. Purchases you make on your due date will be added to your current billing cycle, which will likely be due on your next payment due date. You may use your consumer credit card Account for Purchases, Balance Transfers, Cash Advances, BiltProtect Rent ACH transactions, Bilt Rent Transactions, and any other transactions we allow. You promise to use your Account only for lawful personal, family, or household purposes.

Received Torn Or Mutilated Note from ATM? Here’s How You Can Exchange It From Bank

Pay the minimum due.This is a basic safety measure that will ensure you never miss a payment. It’s especially useful if you want to review your bills each month before paying them manually, but worry that you might overlook a deadline. Critical illness will be covered under the BalanceCover product for credit cards. If you choose to discuss your credit card account with us in Spanish, Chinese, Korean, Vietnamese, or Tagalog, please read the following.

- Missing the credit card bill payment could be damaging to one’s credit score, and so, one should keep a track of it.

- In addition, due date changes usually take at least 1 to 3 billing cycles to go into effect for most cards.

- This change means that your statements will be issued on the 20th day of each month and your payment due date will usually be on the 10th day of each month.

At the end of each month, your card issuer sends you a statement with your account’s balance, interest charges and other charges. This statement has a date on which it closes and a date on which you have to pay in order to keep your account in good standing. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs. Recently a user posted on social media about him facing an issue with regard to his credit card billing.

How To Use NPS Prosperity Planner To Plan Your Retirement

There is no single best day to pay off your credit card — as long as it is before your due date. If you are trying to make your payment on time and you are paying your bill online, be sure to submit your payment prior to your payment cutoff time. If you are sending in a payment by mail, make sure to factor in some extra time for mailing and processing. We post payments to the Billing Cycle within which they are received. Any payment in excess of the Minimum Payment due is applied based on the balances reflected on your last billing statement. If you decide to disable the BiltProtect feature, you may make a Bilt Rent Transaction on the Bilt website or Bilt mobile application.

What is a credit card grace period?

A credit card grace period is a time during which your credit card issuer does not charge interest on purchases. Most credit cards offer a grace period, but it takes effect only after you pay your statement balance in full by the due date. If you regularly carry a balance from one statement to the next, you won’t get a grace period.

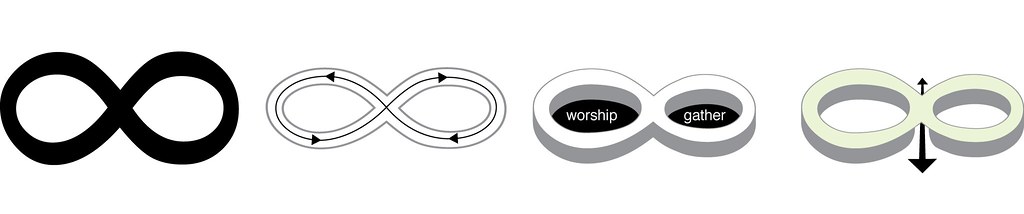

The cycles that can cause real unmanageability are the incoming revenues. In addition to the numerous advantages, cycle billing has a number of disadvantages. It can, in addition to improving financial management, make it easier for businesses to track and manage their finances.