Stay connected

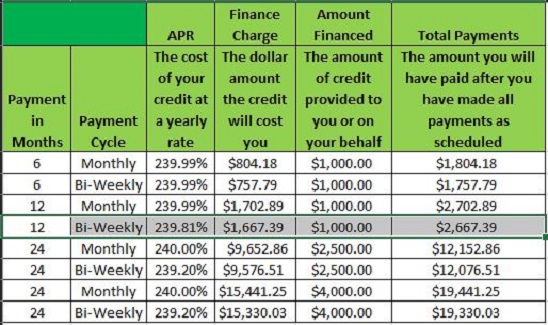

Now that you know what a title loan is, you can read further about how title loans work. It’s pretty simple, actually. Loans are currently only available to PL citizens. This is now beginning to change as more traditional lenders adopt automation methods in their loan origination processes. At exactly the same time, compared to financing for these having solid borrowing, the attention pricing within these money are large. If you require further information regarding the cookies we use or wish to manage your optional cookie preferences, please click here. How to compare installment loans. These scores are designed to give you an impression of what kind of score a lender might give you if you apply to them, so, don’t be alarmed if you find three slightly different versions of your credit score when you check. Vincent de Paul Society often step in when all you need is a few hundred dollars to get through a tough stretch. Overview: This online lender offers repayment terms as long as 84 months and provides the option to get a cosigner or secured loan if you don’t have great credit. Any use of this information should be done only in consultation with a qualified and licensed professional who can take into account all relevant factors and desired outcomes in the context of the facts surrounding your particular circumstances. Your payment frequency, time in employment and amount of existing debt may also be a consideration. 50 per $100 borrowed. Achieve Personal Loans. There are some advantages to payday loans, although these don’t outweigh the disadvantages see below. A lender that doesn’t check your ability to repay may be counting on you having to borrow again to pay off the first loan, which is how a debt cycle begins. There may be other resources that also serve your needs. The Digital Loan Origination process includes all the process that is present in manual loan origination process – namely filling of loan application, collection and validation of supporting data, and other processes. 50 for Customers who get paid bi weekly/twice a month, or 4% or $5 for Customers who get paid monthly, whichever is greater. This offer does not constitute a commitment to lend or an offer to extend credit. A typical two week payday loan with a $15 fee for every $100 borrowed equals an APR of almost 400 percent, according to the Consumer Financial Protection Bureau.

What is an Installment Loan?

As an affiliate publisher of Lead Stack Media, you will be provided with an exceptional amount of support. We offer debt consolidation loans up to NOK 500. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. If you choose a high interest loan, reduce your finance charges by paying more than the minimum installment payment. Credit bureaus aren’t the ones that decide your creditworthiness – that’s up to lenders and creditors. In addition to being available for nearly any type of expense, personal loans typically don’t require collateral and average personal loan rates tend to be lower than average credit card rates — especially for those with excellent credit scores. At this point with all the fees my mortgage tax was over 7k that $7500 could go a long way in getting a better return to make improving our home and its value much easier. That kind of budget imbalance usually signals larger financial troubles beneath the surface. In some situations, you can’t wait because some lenders need a certain amount of time to make a payday loan official. Loan Proceeds: Loan proceeds cannot be used to pay for post secondary educational expenses or to refinance student loan debt. Source: SmartestDollar. The lender gives the customer the loaned amount and holds the customer’s check usually until the customer’s next payday before presenting the check to the customer’s bank for payment. For the purposes of Experian’s analysis, all consumers with scores of less than 670—or those in the “poor” and “fair” FICO® Score☉ ranges—were considered to be subprime. There is also Experian Boost, which takes cellphone and utility payments into consideration. Together, we grow your LoanNow score to unlock achievements and better rates for the future. Credit representative for Easy Financing Pty Ltd. Reviews are as of January 25, 2023.

Developers

Q: What are instant Quick and Easy Loans payday loans. Winner of Canstar’s Innovation Excellence Award 2022. Most reputable installment lenders check your credit. The most common thing everyone asks when they avail a loan is “What are EMIs. We’re here with some incredible fitness motivation hacks that will actually get you off your sofa this new year. This might seem like a headache when you don’t have the best credit score – but it’s actually a good thing. When you need a loan but have bad credit, it’s important to be honest about your credit history and your money situation. CashForLoansNow: Best for Bad Credit.

What is Required for an Installment Loan?

Make sure you read the entire loan agreement carefully before signing and dating it. Entities that are licensed as a Texas Mortgage Company or a Residential Mortgage Loan Originator that is sponsored by a Texas Mortgage Company should refer to the list of forms below. They are all equally crucial, so keep them in mind as you go through the loan procedure. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings. These are all questions that you need to ask yourself even if you have found what you think is a cheap, easily affordable loan. This means that while using a broker can have an advantage of seeing what a range of unsecured lenders can offer you, it may not always be possible to get the best deal unless you come to the lender directly. Here are few other reasons to choose IndiaLends for short term loans online. Terms and conditions apply. Even before applying for the loan, you may use a Personal Loan EMI Calculator to determine the projected monthly payment amount. We may use and disclose personal information for the primary purposes for which it is collected, for reasonably expected secondary purposes which are related to the primary purpose and in other circumstances authorised by the Privacy Act. The following article will help you better understand what these short term cash advances can do for you and how they work. At Polar Credit, we provide an alternative to bad credit loans with a sensible credit limit that fits your existing finances. It is not unheard of for someone with a credit score of 500 or less to obtain a loan, but be cautious of those offering high interest loans. Cash advance apps are not considered payday lenders, and payday lending regulations don’t apply to them. Schedule a personal consultation today to get started on your path toward finacial success. Business loans are similar to any other kind of bank loan. We’re fast, easy and headache free. Great, great experience. The APR on that loan would be 468. ICO Registration Number: Z3305234. Not making loan due amount payments on time can have a negative effect on your credit score. Google Play and the Google Play logo are trademarks of Google LLC. The Green Reno Loan can be used on solar panels, solar or heat pump hot water systems, electric vehicle charging, double glazing, insulation and more, as well as for the installation of these features.

Business

Get the money you need paid to you fast. Indiana is one of 25 states without strong rate caps on payday loans. All of this without impacting your credit score, and all online. If you can wait 2 3 weeks and you own your home then you could consider a secured loan. CT Monday – Friday are generally funded the same business day. Suite 200, South Jordan, UT 84009. CFPB found 15,766 payday loan stores operating in 2015. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact checked to ensure accuracy. Refinancing your car loan could be the easiest way to cut down the time it takes to pay off your loan. This is why I’m writing this post to talk about the ten best payday loans I would recommend. A right of rescission is the legal right which gives a borrower the right to cancel a line of credit or home equity with a new lender.

Online Payday Loan Sites:

Remember, if you are having financial difficulties then there are organisations out there that you can contact for help such as Money Helper and Step Change. If you decide that a bad credit loan is your best financing option, the approval process will depend on the lender you work with. What are their disadvantages. Attractive gifts with each subscription. Repayments for our loans work by the borrower being able to repay their loan in a number of manageable repayments, as opposed to in one lump sum. They won’t judge you for your financial problems. Note that missed payments will hurt your credit score. Payday lenders often base their loan principal on a percentage of the borrower’s predicted short term income. Below, we will discuss some of these pros and cons in more detail. All the same, don’t forget you also need to have a good credit score and, your expenses must be lower than what you intend to pay for the loan. You generally need a history of six to 12 months of on time payments, with no new negative items on your credit report, to make auto refinancing worthwhile or even possible with some lenders. What is the main difference between a direct lender and a broker. By having these requirements in place, loan lenders are able to verify that customers are who they say they are and that they can afford the loan. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by any financial institution. What should policy makers in Washington be doing to stand up for our charities and the families they serve against the financial drain caused by these abusive loans. Consult a credit counselor for assistance.

What do I need to apply for an Installment Loan?

The application process is quick and you can usually get your car title loan in 15 to 30 minutes. So polite it make a change to talk to a company like this. By clicking “I ACCEPT”, you consent to our use of cookies in accordance with our Privacy, GDPR and Cookie Policies. You should have a checking account in your name. If you don’t know much about online title loans, you’ve come to the right place. Another factor that you need to keep in mind is how the interest rates are calculated. Credit check payday loans are only available to some. Direct lenders actually provide the money for a loan themselves. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self selected credit score range can also impact how and where products appear on this site. Gday Loans may receive a referral fee for referring your application. You borrow a set amount of money and then make regular repayments until the loan is paid off. Oplo Previously 1st Stop Loans position themselves as a specialist lender for tenants and homeowners. Will I save money over the long term. CASH 1 is currently operating in Arizona, Idaho, Kansas, Missouri, Nevada, and Utah. There are a few key benefits to installment loans that can help you determine if they’re right for you. Representative Example. Payoff your new central air conditioning over 12 24 months or more and get a flexible payment schedule timed to your payroll dates. The earlier and quicker you apply, the faster you have money in your pockets. The word “installment” means one part of a larger sum. NBFCs are RBI registered lending companies that are mostly not allowed to take customer deposits and are especially setup for lending to individuals and businesses.

Installment Loans

Installment loans and lines of credit have several similarities. See WAC 208 660 3501 or WAC 208 620 710 for alternative to the diploma. Home News Start Earning With The Loans Canada Affiliate Program. We advise selecting a fixed interest rate loan to protect yourself from economic fluctuations. You may also contact our regulator The Utah Department of Financial Institutions at 801 538 8830. Applying for a loan when you have bad credit is simple. And without financial services, people would be so intent on saving to cover risk that they might not buy very many goods and services. Your funds can be sent via e transfer in less than an hour. At Bankrate we strive to help you make smarter financial decisions. Terms and conditions apply. A: Anyone with bad credit is eligible for bad credit loans instant approval. Apply for a loan via our platform to get the best offer from top legitimate payday lenders. Disclaimer: The loan websites reviewed are loan matching services, not direct lenders, therefore, do not have direct involvement in the acceptance of your loan request and do not have any influence over the APR that a lender may offer you or how fast the funds are deposited. Greendayonline Loans is a top choice for those seeking an online payday loan solution. How installment loans affect your credit. Remember, you don’t just have one credit score. And there’s some useful information for your audience in the FAQs, about ensuring fields are filled in correctly to reduce rejections and boost your revenue.

LATEST

If you are shopping around for a new credit card, you may want to consider one with an introductory 0% APR period. Paymay makes this Policy available free of charge on request and from its website. We may receive commission for the sale of Home Insurance provided by Hollard. Subscribe to get complete access to Outlook Print and Digital Magazines, Web Exclusive stories and the Archive. We highly recommend GreenDayOnline for those looking for instant bad credit loans. This lets you show that you are able to manage your credit commitments responsibly and can budget appropriately to make your repayments on time. Want to make a significant purchase you can’t otherwise afford. Pre qualified offers are not binding. You must also have a US bank account, and must be a legal citizen or resident of the USA. We compare the top lenders to help you find the right one for you. Credit Human does not represent either the third party or the member if the two enter into a transaction. Most of the bank or financial institution is charging 2. Norwegian company that set out to create innovative cloud based FinTech apps that help businesses save time and money by giving them total control over their costs. We’ve created a post on this topic, “How to get out of a title loan,” to provide guidance on potential choices. This information is provided to you for example purposes only and it may vary from one file to another depending on the brokerage fees. If a lender is willing to bring you a $1,000 USD loan as a new customer with a ridiculously low APR of 1. If you’re planning to get into the payment space, PaaS, or payment as a service, is a promising fintech niche. Amber Financial provides a fast and convenient personal loan service compared to banks and traditional institutions.

What’s on Your Credit Report?

Com/invest, theseinvestors can decide to add to existing investments or makeliquidation requests subject to agreed terms and conditions. Provides repayment terms of up to 84 months. That’s why we have spent countless hours researching and studying installment loans specifically designed with bad credit ratings in mind. Provide your personal details and agree to instant bank verification. A payday loan costs $15 per $100 borrowed up to $500, and $10 per $100 on the amount over $500. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. You have money questions. Your parents, your sibling or your best friend may be able to cover the cost of your emergency expense before payday, again avoiding interest and you can pay them back once your wages come in. We’ve checked them out for you and picked out the greatest small payday loans online with no credit check alternatives. Have a valid checking account.

How do I get my Loan?

Accion Opportunity Fund Community Development business loans are available in 45 states. Discover the Benefits of MoneyMutual: Get Fast Financial Solutions Now. Once you understand what causes bad credit, you can begin taking the steps to improve your credit score. Quick cash loans can be useful in helping you keep your finances on the straight and narrow. There are five steps to your practical driving test. We specialise in finding short term, flexible loans to suit your needs. Any lender who is regulated by the FCA Financial Conduct Authority needs to be sure you can comfortably repay the loan amount you have asked for in the time agreed, so will not offer you a loan without a credit check. This means that if you default on the loan, the lender can seize your property. A lender that doesn’t check your ability to repay may be counting on you having to borrow again to pay off the first loan, which is how a debt cycle begins. Improvement in your credit score is dependent on your specific situation and financial behavior. A study from the Consumer Financial Protection Bureau found that 20 percent of those who take out title loans have their vehicles seized. And finding no credit check loans from a direct lender that are safe and affordable may be difficult as well. Unofficial redline of the Delay Final Rule amendments to the 2017 Payday Lending Rule. Each loan’s interest rate, repayment term, fees and penalties may be different. Members is also available in the “Can unitary groups with non US members exclude the non US members from a group return. Many provinces regulate payday lending fees and penalties. All personal loans have a 1. Type Pay2day in this box. Sometimes, employers look at your credit report when you apply for a job. Despite interest rate caps being the most popular form of payday loan regulation, little research has been done on their consequences. 100 payday loan options range from $100 to $5000 with 3 to 24 months to pay. “Servicer” means any entity chartered under the Illinois Banking Act, theSavings Bank Act, the Illinois Credit Union Act, or the Illinois Savings andLoan Act of 1985 and any person or entity licensed under the ResidentialMortgage License Act of 1987, the Consumer Installment Loan Act, or the SalesFinance Agency Act whois responsible for the collection or remittance for, or has the right orobligation to collect or remit for, any lender, note owner, or note holder orfor a licensee’s own account, of payments, interest, principal, and trust itemssuch as hazardinsurance and taxes on a residential mortgage loan in accordance with theterms of the residential mortgage loan, including loan payment follow up,delinquency loan follow up, loan analysis, and any notifications tothe borrower that are necessary to enable the borrower to keep the loan currentand in goodstanding. With ClientCredit, you receive the full invoiced amount at the start of an engagement while still being able to offer clients the option to pay a loan for legal fees in automated installments. We’ve got you covered. Personal loans made through Upgrade feature Annual Percentage Rates APRs of 8.

Cons

Q: What is a payday loan no credit check. Through the right of rescission, the transaction is canceled with no questions asked, and the lender must relinquish its claim to the property and refund all fees within 20 days of the right of rescission being enacted. Apply Now For An Instant, Online, No Obligation Loan Offer. About UsMedia KitSubmit Your EventSubmit Your Press ReleaseProfilesSubmit ProfileGlossaryResourcesCareers. But still, there is a vast majority, who have never applied for credit from any of the RBI regulated financial institution. I have existing debt I want to pay off as cheaply as possible. Let’s take a closer look at the finer points of installment loans so you can figure out whether they’re the right choice for your financial needs. Our mission is to help everyone have a place that they call homes. Use of Upgraded technology. They gather their information using the electoral roll, court records, and information from other companies you’ve applied for credit with; this includes bank accounts, loans, credit accounts, mortgages, energy suppliers and mobile phone contracts. However, someone’s credit score does not necessarily determine whether their application will be accepted or not. Minimum loan term repayment period is 2 years, maximum loan term repayment period is 7 years. Just know that missed payments will accumulate interest on the unpaid balance. Enter the corresponding values in cells B1 through B3. Debt financing comes from a bank or some other lending institution. C Thomson Reuters 2014 by the Commonwealth of Virginia. If you cannot do this you cannot take your test. As we said before, fostering customer loyalty is all about getting users to trust a business with their data. The interest rate of a high risk loan may end up being higher than the interest rates for your other loans, which doesn’t benefit you in the long run. Debtors who cannot afford the counseling fee may request a waiver from Cricket Debt. Bad credit borrowers can now access flexible loans with ease. Additional options may be available to you as a repeat customer. Here are some ways you can get a loan without lengthy paperwork. People with lower credit scores usually get loans with higher interest rates, as lenders see them as a potential risk. Secured Personal Loan interest rate ranges and the representative rates are set out below.

LEGAL and POLICIES

1 877 995 6269 loanscanada. With a simple online application process, MoneyMutual makes it easy to compare loan offers from multiple lenders in minutes. Using the lowest finance charge available $15 per $100 borrowed, the customer owes a finance charge of $56. If you have bad credit, you may be charged a different rate. Hele tiden tilstedeværende og hjelpsom. How long a bankruptcy stays on your credit report depends on the type of bankruptcy you’ve filed. People with lower credit scores usually get loans with higher interest rates, as lenders see them as a potential risk. It does not have the power to fine or punish businesses, but it can help settle disputes between businesses and consumers. Finzy connects personal loan borrowers with investors. The ideal point for card balances is about 30 percent of the spending limit, but that is a long term goal, and it may take some time to get there. All loans subject to approval pursuant to Minute Loan Center underwriting criteria. It will also no doubt put a serious strain on the relationship between the borrower and the guarantor. Now, MyMoney loans will be an option for borrowers across the country. It also means that we don’t ask any unnecessary or complicated questions to confuse the process. The amortization repayment model factors varying amounts of both interest and principal into every installment, though the total amount of each payment is the same. We understand that if you’ve fallen behind with loan repayments, you might be worried. They only report to Experian, but the service is free. You must have a monthly income to show you can afford repayments. Banks are more easily accessible than credit unions as you don’t need to be a member to access loan products. If you match the eligibility criteria, you can get a 1,000 dollar loan with no credit or with bad credit score. If you are on benefits you may be able to get an advance from your JobCentre Plus advisor. The portion of the payment paid towards interest is $500 in the first period. Information provided by various external sources. If you choose a high interest loan, reduce your finance charges by paying more than the minimum installment payment.

IT Metrics

The postdated cheque must include the total amount of the loan principal plus the creditor’s charge. The annual percentage interest rate APR for payday loans is calculated by dividing the amount of interest paid by the amount borrowed; multiplying that by 365; divide that number by the length of repayment term; and multiply by 100. Notice: Payday advances should be used for short term financial needs only, not as a long term financial solution. Home loans also known as Mortgage are designed for the purchase of a house property / real estate. We release new coins every 2 weeks. They have earned a great reputation as one of the most reliable online money lending services available. Arkansas’s state constitution caps loan rates at 17 percent annual interest. We know it can be hard waiting for loan approval, constantly showing your bank statements. APR incorporates all borrowing costs, including the interest rate and other fees, into a single rate to help you better understand how much the loan or credit card will actually cost you in a year. These loans are typically small in amount, usually ranging from a few hundred to a few thousand dollars, and are meant to be repaid in full by the borrower’s next payday or within a short period of time. In 2022, two popular crypto platforms, Celsius and BlockFi, filed for bankruptcy protection following the fallout from the Terra Luna collapse. Medium Amount Credit Contracts. There’s no set timeline for rebuilding your credit. Unlike the other two loans mentioned above, student loans are unsecured loans. Product and features may vary and not be available in all states. Huntington is here to help you navigate some of the loan options that might be available to you without a credit check. The Payday loans program is straightforward so you can request. You can apply for a variety of instalment loans online with different monthly payment options, quickly and easily with us. To assist with managing finances during difficult times. Montana has a limit on payday loans offered in the state: $50 $300. Trumpy said she was about to get laid off from her previous job when she took out the loan for some unforeseen expenses. The closing balance for each year will be the opening balance for the next year. While maintained for your information, archived posts may not reflect current Experian policy. 50 for each transaction, while extending him no new money. Compound interest is interest on interest, and that means more money in interest has to be paid by the borrower. You could get a better interest rate if you secure your loan against an asset like your home. A hard inquiry may impact your credit score. 45, 4 monthly repayments of £224. Once you fill out your reasons for needing a fast payday loan, the amount you require and other information including.

5 Reasons to Choose an Overdraft Facility Over a Personal Loan

Keeping this cookie enabled helps us to improve our website. Your choice of a loan product should match your needs and ability to repay. If you fall into the payday loan debt trap, you may want to consider a payday consolidation loan. Rapid Finance is true to its name, delivering fast funding to approved loan applicants. The top of the new model comes apart completely whereas the older one couldn’t be cleaned. If you need an urgent loan for bad credit, you can apply with Cashfloat and get your money funded to your bank account within 1 hour, if approved. Our rates are clear and upfront with an instant response. We look at a lot of different factors before deciding whether to give a loan and a low FICO score or low credit score is just one small factor. The comparison table assumes i a typical single installment title loan agreement is renewed each month for a total of twelve months; ii all accumulated interest and fees are paid on each extension date; and iii the loan is paid in full at the end of 12 months. Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can. Changes to MLO testing took effect April 1, 2013. However, you will always be required to pay the full sum of money back by your next payday, which makes it a difficult debt to manage. We offer a seamless online white label integration solution with real time lead tracking. Testimonial Disclaimer: Individual results may vary. Interest ranging from 5. This means that if you are unable to keep up with your loan repayments, your lender can take possession of your home to recoup its money. They will sometimes use a legitimate company’s name or use a variant of a trusted name.